Floor Plan Interest Expense

In general it limits a taxpayer s interest expense deductions for a taxable year to the sum of 30 percent of adjusted taxable income ati and its business interest income.

Floor plan interest expense. Floor plan statements and inventory information available online. New and used vehicle floor plan financing at competitive rates and terms focused on meeting the needs of new car franchised dealerships. In a change made by the cares act taxpayers can elect to use their 2019 ati in computing the 2020 limit helping taxpayers whose income declines in 2020. Floor plan financing interest expense.

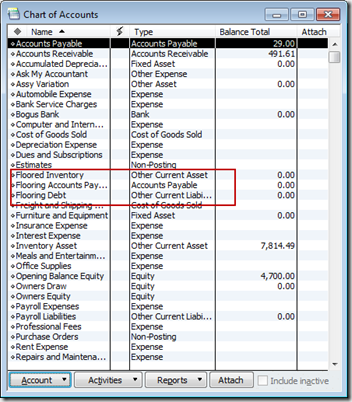

Floor plan financing interest expense is interest on debt used to finance the acquisition of motor vehicles held for sale or lease where the debt is secured by the acquired inventory. Other debt likely includes floorplan interest but not curtailment for inventory acquired before 2 15 20. This floor plan finance formula will require a dealer to have a good handle on total dealership expenses and inventory for the entire month. The loans are also inspected periodically by lenders by checking the inventory of all collateralized vehicles.

Floor plan loans are among the safest of all financial instruments. Interest but only interest on any other debt obligations that were incurred before 2 15 20. Taxpayers are also permitted to elect to apply the more restrictive 30 of ati limit. But because inventories are so immense the car business is very sensitive to both floor plan interest rates and the tax treatment of interest expenses.

Your monthly selling expenses are variable monthly expenses that are not charged to the. Variety of floor plan structures and interest rate options to meet your needs and reduce your interest expense. Floor plan financing interest expense is not subject to the section 163 j limitation. To figure this out a dealer would subtract their monthly selling expenses from their total expenses for the month.

To do this subtract your monthly selling expenses from your total expenses for the month. First figure out your monthly holding cost. For example automobile dealerships utilize floor plan financing to run their businesses. This floor plan finance formula requires a good handle on total dealership expenses and inventory for the entire month.

Certain taxpayers involved in the sale of motor vehicles may also be able to increase their section 163 j limitation by any floor plan financing interest expense. Floor planning is a form of financing for large ticket items displayed on showroom floors.