Floor Plan Financing Interest Expense Definition

Floor plan financing interest expense is interest paid or accrued on floor plan financing indebtedness.

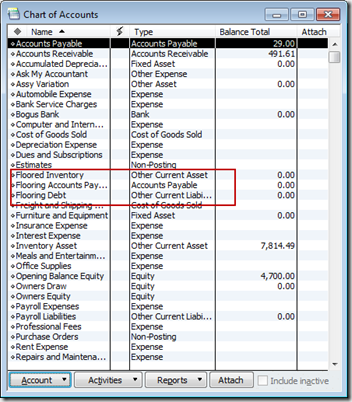

Floor plan financing interest expense definition. Definition of floor plan financing interest expense following the changes made to the statute discussed above the proposed regulations provide that certain business interest expense paid or accrued on indebtedness used to acquire an inventory of motor vehicles is deductible without regard to the irc 163 j limitation. But because inventories are so immense the car business is very sensitive to both floor plan interest rates and the tax treatment of interest expenses. For example automobile dealerships utilize floor plan financing to run their businesses. The loans are also inspected periodically by lenders by checking the inventory of all collateralized vehicles.

Floor plan financing interest expense sec. 163 j rules which covered so called earnings stripping and denied a corporation s interest deduction for disqualified interest to the extent it had excess interest expense in a year that its debt to equity ratio was greater than 1 5 to 1. Floor plan financing indebtedness is indebtedness that is used to finance the acquisition of motor vehicles held for sale or lease and that is secured by the acquired inventory. Floor plan financing interest expense is interest on debt used to finance the acquisition of motor vehicles held for sale or lease where the debt is secured by the acquired inventory.

For example if you own an automobile dealership and paid. The exception to the 30 percent limitation on business interest allows auto dealers to deduct 100 percent of the interest expense on financing associated with the cost of. Floor plan financing interest expense is not subject to the section 163 j limitation. First figure out your monthly holding cost.

Lastly floor plan financing interest is interest on indebtedness used to finance the acquisition of certain motor vehicles held for sale or lease. However auto dealers won a reprieve from this limitation in the preservation of a 100 percent deduction of floor plan financing interest. Your monthly selling expenses are variable monthly expenses that are not charged to the. Unlike former section 163 j which only applied to corporations and was considered primarily to address what the government viewed to be earnings stripping cross border debt financings new.

This floor plan finance formula requires a good handle on total dealership expenses and inventory for the entire month. Floor planning is a form of financing for large ticket items displayed on showroom floors. Floor plan loans are among the safest of all financial instruments. Floor plan financing interest is interest on floor plan financing indebtedness which is indebtedness used to finance the acquisition of motor vehicles boats or farm machinery for sale or lease and secured by the inventory acquired with the proceeds of the indebtedness sec.