Floor Plan Financing Interest 163 J

Floor plan financing interest expense is interest on debt used to finance the acquisition of motor vehicles held for sale or lease where the debt is secured by the acquired inventory.

Floor plan financing interest 163 j. 163 j for tax years beginning after dec. Its floor plan financing interest for the taxable year. Floor plan financing interest expense is not subject to the section 163 j limitation. 163 j generally limits a taxpayer s business interest expense deduction to the sum of its business interest income 30 of adjusted taxable income and any floor plan financing interest expense for the tax year.

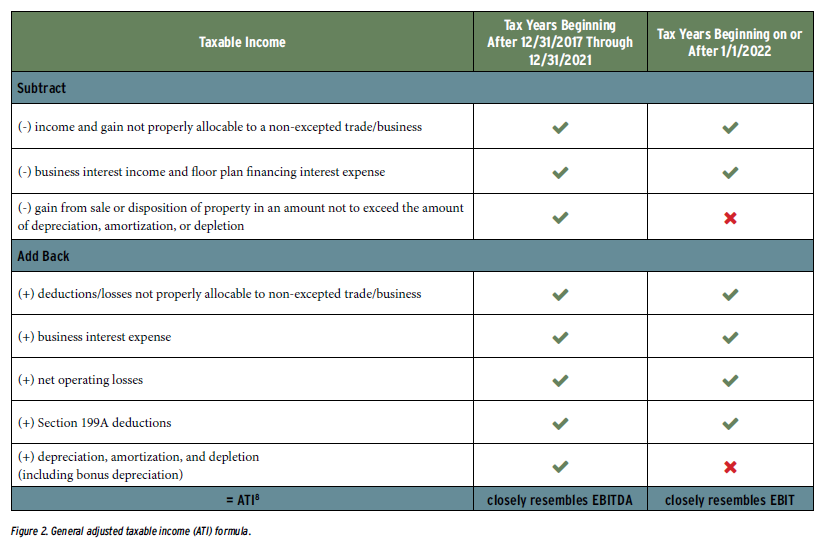

In general it limits a taxpayer s interest expense deductions for a taxable year to the sum of 30 percent of adjusted taxable income ati and its business interest income. 30 or 50 for 2019 and 2020 as amended by the cares act of the taxpayer s adjusted taxable income ati. Any business interest expense in excess of this limitation is carried forward indefinitely and may be deducted in future years. Definition of floor plan financing interest expense following the changes made to the statute discussed above the proposed regulations provide that certain business interest expense paid or accrued on indebtedness used to acquire an inventory of motor vehicles is deductible without regard to the irc 163 j limitation.

The taxpayer s floor plan financing interest expense. New section 163 j limits the taxpayer s annual deduction of interest expense to the sum of. Floor plan financing interest expense. The taxpayer s floor plan financing interest expense for the year.

Its business interest income for the taxable year. The taxpayer s business interest income. 30 of its adjusted taxable income for the taxable year. Enacted on december 22 2017 with the tax reform legislation new section 163 j 1 limits a taxpayer s annual deduction for business interest to the sum of.

Certain taxpayers involved in the sale of motor vehicles may also be able to increase their section 163 j limitation by any floor plan financing interest expense. For tax years beginning after 2017 the limitation applies to all taxpayers who have business interest expense other than certain small businesses that meet the gross receipts test in section 448 c exempt small. Tax law amended section 163 j to disallow a deduction for net business interest expense of any taxpayer in excess of 30 of a business s adjusted taxable income plus floor plan financing interest. 31 2017 business interest expense deductions are limited to the sum of.

Who is subject to the section 163 j limitation.

.jpg)