Floor Plan Financing And Tax Cuts And Jobs Act

115 97 is a congressional revenue act of the united states originally introduced in congress as the tax cuts and jobs act tcja that amended the internal revenue code of 1986 major elements of the changes include reducing tax rates for businesses and.

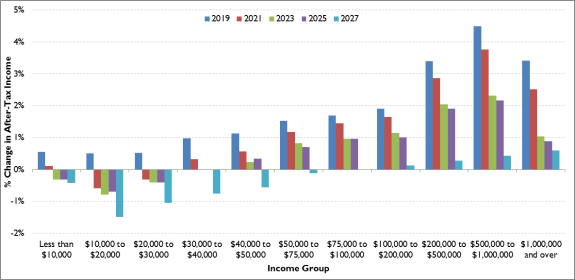

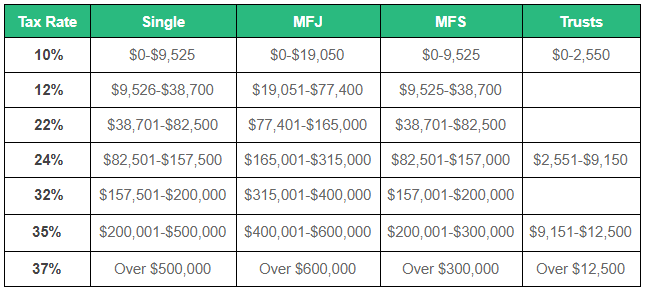

Floor plan financing and tax cuts and jobs act. The tax cuts and jobs act of 2017 tcja makes small reductions to income tax rates for most individual tax brackets and significantly reduces the income tax rate for corporations. The tax cuts and jobs act of 2017. Repeals the corporate alternative minimum tax amt for tax years beginning after dec. The tax cuts and jobs act of 2017 tcja makes sweeping changes to the tax code but only a few directly impacting retirement benefits.

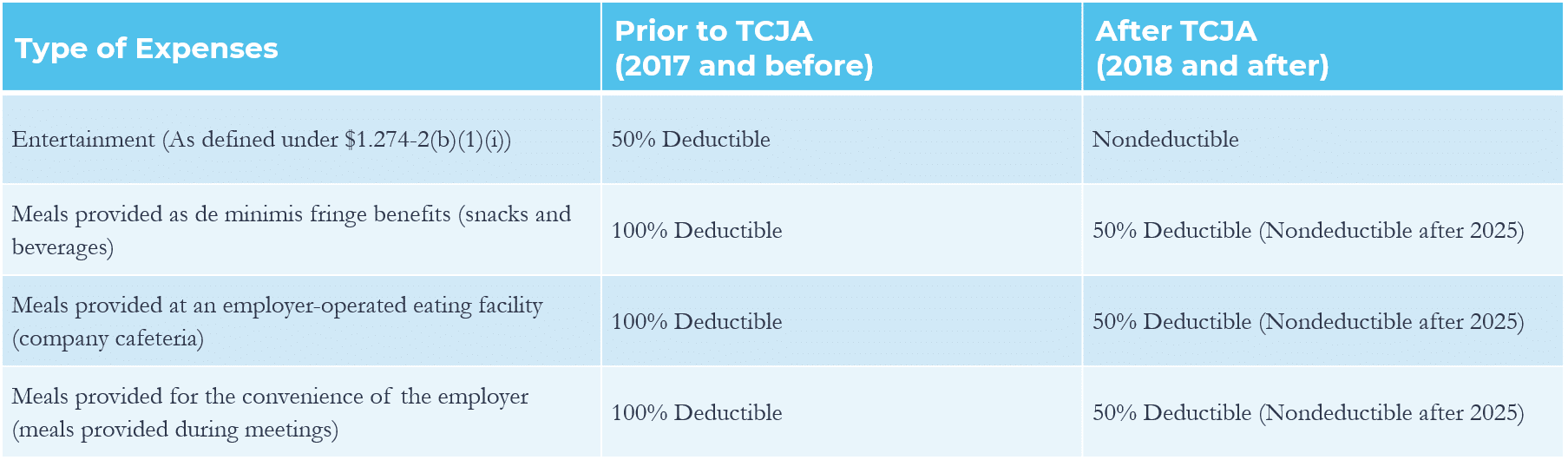

115 97 known as the tax cuts and jobs act tcja and asked for general comments on regulations it plans to issue. The tax cuts and jobs act tcja changed deductions depreciation expensing tax credits and other tax items that affect businesses. On december 22 2017 the most sweeping tax legislation since the tax reform act of 1986 was signed into law. 115 97 made sweeping changes to the tax law reducing the c corporation top income tax rate from 35 to 21 creating a 20 tax deduction for qualified business income under new sec.

Some provisions of the tcja that affect individual taxpayers can also affect business taxes. The legislation known as the tax cuts and jobs act tcja p l. 163 j the deduction for business interest is limited to the sum of 1 business interest income. The 2017 tax cuts and jobs act.

Widen and adam r. Reduces the corporate tax rate to a flat 21 for tax years beginning after dec. 199a limiting the state and local tax salt deduction to 10 000 increasing the standard deduction to 12 000 for single taxpayers and 24 000. It was designed to boost business investment by lowering the u s.

Corporate tax rate from 35 percent to 21 percent. Tax tax advantaged investments tax controversy congress has passed and the president is expected to sign the tax cuts and jobs act of 2017 the republican tax reform bill. The centerpiece of the republican agenda was the tax cuts and jobs act tcja. 163 j as amended by p l.

The biggest change is the elimination of the ability to undo. Summary of domestic business and individual provisions. 2 30 of the.