Floor Pivot Calculator

Using price data from the previous day s trading activity.

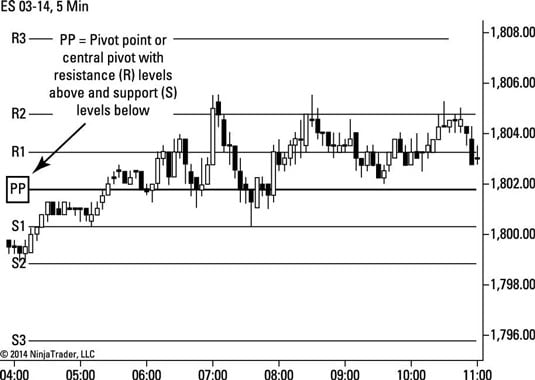

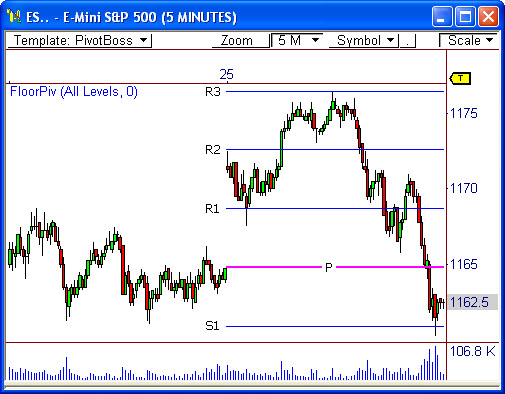

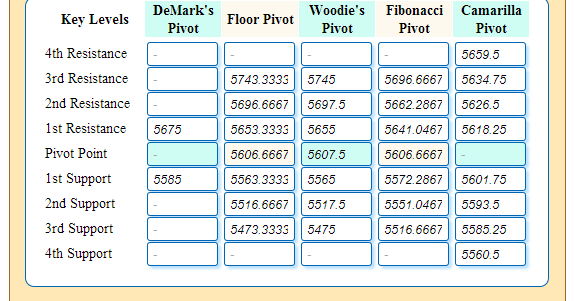

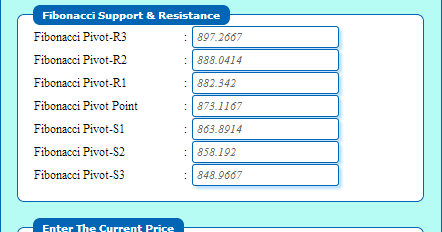

Floor pivot calculator. The pivot point is interpreted as the primary support resistance level the point at which the main trend is determined. How to calculate floor trader pivots the default time frames include daily weekly or monthly pivot points and they can be calculated as follows. Calculate floor trader pivots. Pivot points are also know as floor trader pivots or pivots or floor pivots or session pivots.

The floor pivot points presented in the first column of the calculation results table are the most basic and popular type of pivots used in forex trading technical analysis. How to calculate pivot points. There are also a number of tools out there that keep track of it each day but these are usually from paid services. Central pivot high low close 3.

Floor trader pivot calculator calculate pivot levels for any trading instrument. There are a few different ways to calculate floor trader pivots but you can pretty easily find a website online to calculate it for you. The pivot point calculator is used to calculate pivot points for forex including sbi fx forex options futures bonds commodities stocks options and any other investment security that has a high low and close price in any time period. The floor pivot points are the most basic and popular type of pivots.

Floor traders and other professionals who do the actual buying and selling of futures contracts in the trading pits of the exchanges generally employ very similar systems for valuing the price of these instruments in. How to calculate floor trader pivots. This system uses the previous day s high low. Depending on the type of pivot formula used you can generally generate and use up to 9 levels.

Although time frames of less than a day can be used pivots are commonly plotted on the daily chart. The most popular method for calculating floor trader pivots is the original formula. There are several different methods for calculating pivot points the most common of which is the five point system. The formula uses the previous day s high low and close to calculate the central pivot neutral area for the market.

These are the places where traders expect support and resistance to occur in the market and as such are used as entry and exit points for trades. The pivot point is interpreted as the primary support resistance level the point at which the main trend will be born first third level resistance and support points serve as additional indicators of possible trend. Previous high previous low.

/dotdash_Final_Using_Pivot_Points_for_Predictions_Feb_2020-01-b3d14a9e8e864875aa404a7664fbb23b.jpg)