Ei Mat Leave Taxes

For maternity and standard parental benefits you ll receive at least 500 per week before taxes but you could receive more.

Ei mat leave taxes. For example if your ei benefits for the period from december 22 to december 28 2018 were paid in january 2019 these benefits are income for tax year 2019 and therefore will be included in your t4e for the 2019 tax year. The quebec parental insurance plan pays a maximum of 75 of your income up to a maximum amount. Regular benefits were paid in 2016. Ei maternity and parental benefits generally pay out only 55 of your income up to a maximum amount.

If you have received maternity or parental benefits during the past tax year you will receive a t4e slip detailing benefits received and taxes paid. Filing taxes on maternity or parental benefits ei benefits are taxable and service canada automatically deducts your federal and provincial or territorial tax from your benefits. For extended parental benefits you ll receive at least 300 per week before taxes but you could receive more if you received the cerb the 52 week period to accumulate insured hours will be extended. If your child was born or placed with you for the purpose of adoption on or after march 17 2019 and you share employment insurance parental benefits with another parent you may be eligible for.

I did not receive any ei benefits in 2019. Ei benefits are taxable income in the taxation year in which they are paid. You received ei maternity parental sickness compassionate care or family caregiver benefits in tax year 2019. 5 extra weeks of standard parental benefits or.

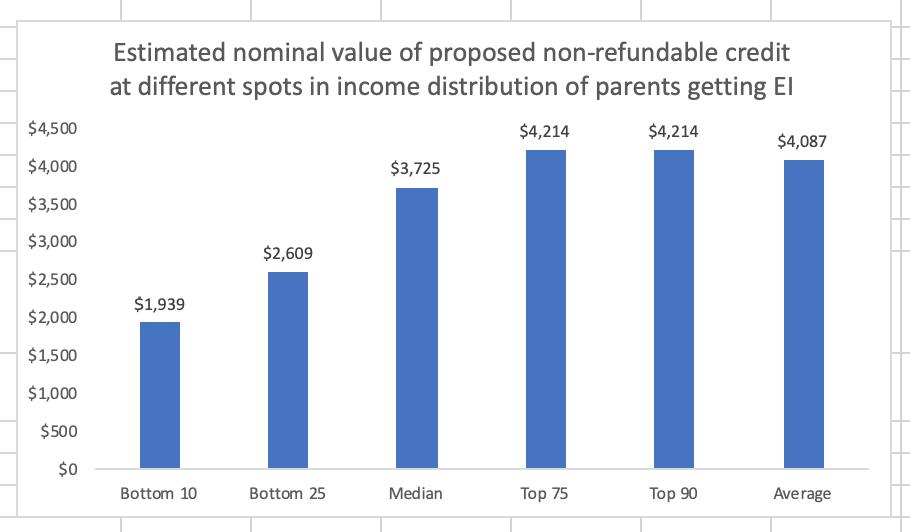

Employment insurance ei payments are calculated at 55. He notes that although higher earning families stand to save more money they also face a larger decline in income during parental leave. The money you get on mat leave is taxable income this income can include anything from a top up from your employer to income from part time employment while on mat leave or from ei or quebec parental insurance plan qpip maternity and parental benefits you are receiving. 8 extra weeks of extended parental benefits.